how are rsus taxed in california

You will owe income taxes on it when you file your 2016 taxes next year. RSU Taxes - A tech employees guide to tax on restricted stock units.

Restricted Stock Units In Nqdc Plans Executive Benefit Solutions

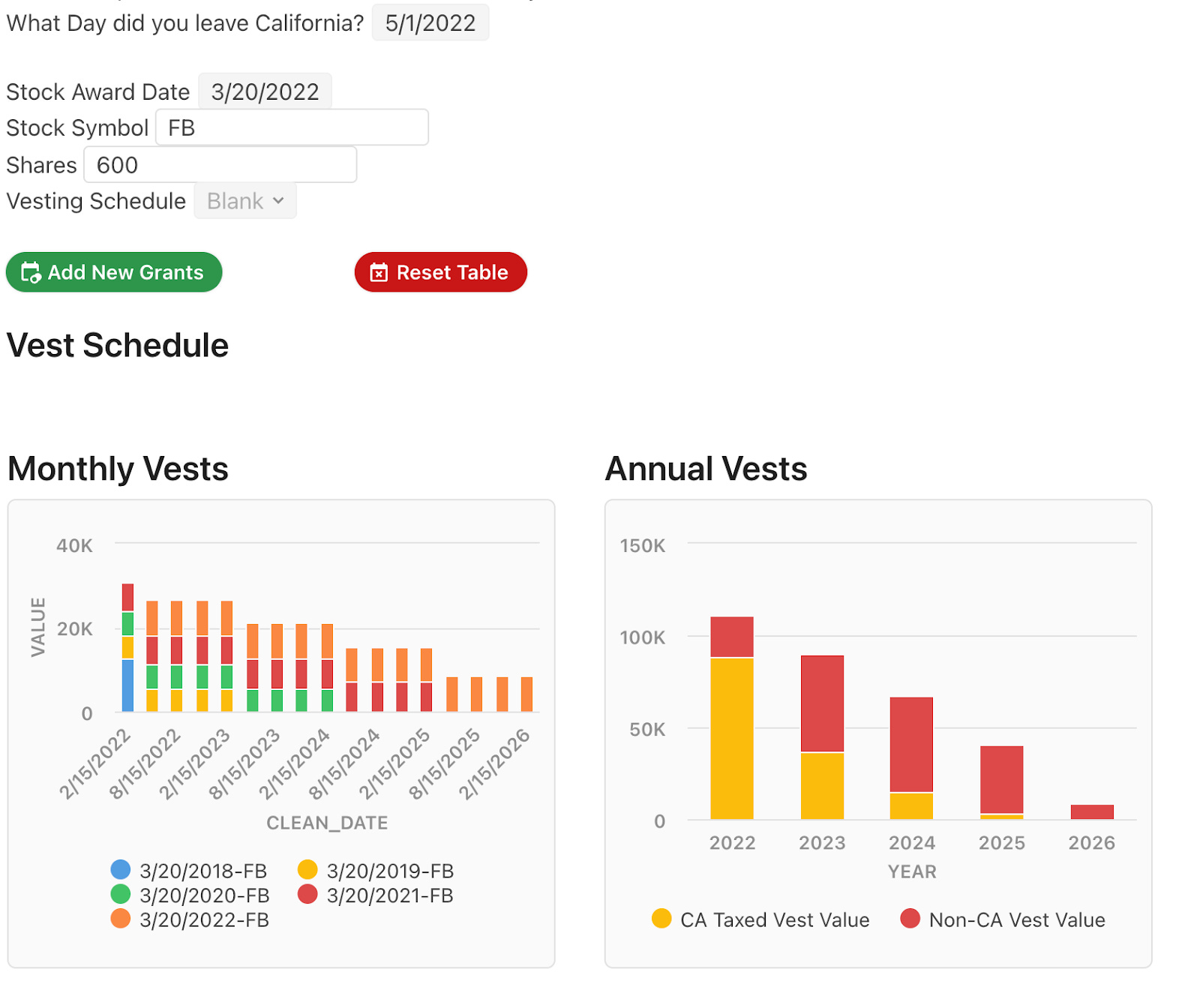

If you were a California state resident on the day that the RSUs were granted you pay California state taxes on the day that they vest based on the amount of time.

/Restricted-stock-unit_final-395366371dc24cfe939e0bc19c0b6102.png)

. Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs. Restricted stock units RSUs are becoming a more common type of compensation in California. Answer 1 of 2.

California taxes RSU income in two steps. In some cases you might pay taxes in California for years after leaving. The RSUs all vested in 2012 two years after the taxpayer became a California nonresident after moving abroad.

What it means is that your stock broker will automatically. Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained. When you exercise ISOs you may owe California.

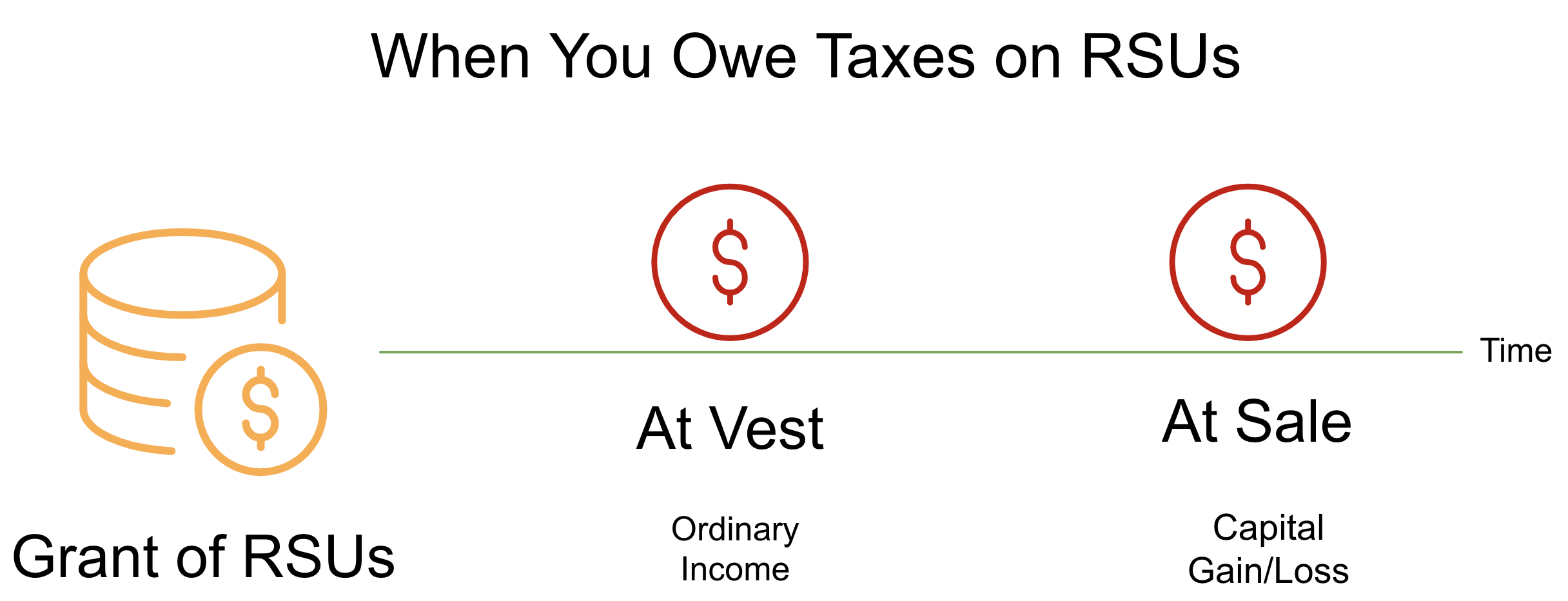

When your restricted stock units vest and you actually take ownership of the shares two dates that almost always. This doesnt include state income Social Security or Medicare tax withholding. Also restricted stock units are subject.

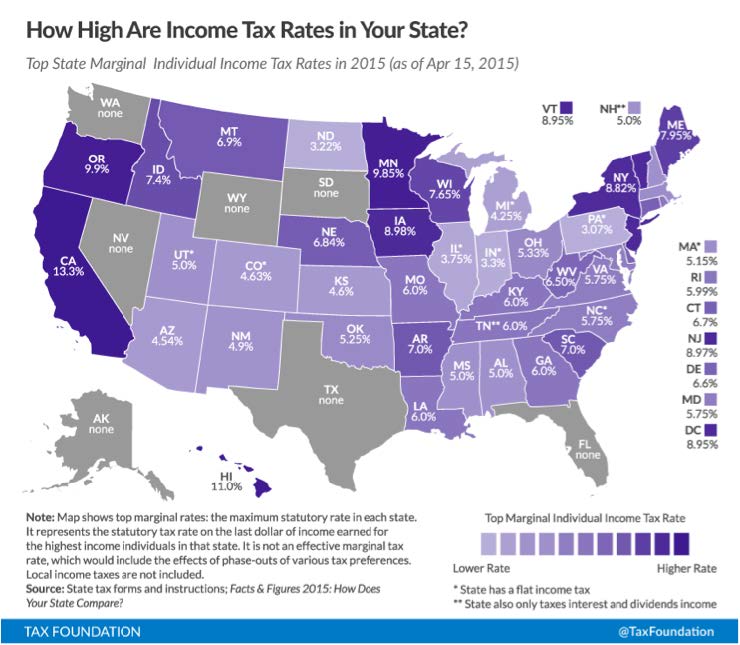

California taxes vested RSUs as income. For California income tax the mandatory withholding rate is 1023. RSUs are taxed as ordinary income thus the rate that the recipient may pay can range from 10 to 37 depending on the recipients household income.

Value of the unvested RSUs before taxes. This is different from incentive stock. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest.

In some states such as California the total tax. Many employees receive restricted stock units RSUs as a part of. Your company is required to withhold a fixed 1023 tax for California income tax.

RSUs in a Divorce. With an all-in tax rate of 15 you only need to pay. Originally reporting the full value of the RSUs on his.

The value of over 1 million will be taxed at 37. For very high earners 360K for single filers and. How Are Restricted Stock Units RSUs Taxed.

This rate is 238 20 plus the 38 tax on net investment income. RSUs including so-called double. For restricted stock units RSUs California has a formula for determining how much of the income from your RSUs is California income.

You lived in California through June 30th and moved to Washington on July 1st. On January 1st 2022 250 shares 14 of your RSUs will vest at a stock price of 10. Taxes at RSU Vesting When You Take Ownership of Stock Grants.

Income taxable by California Total income from restricted stock California workdays from purchase date to vesting date Total workdays from purchase date to vesting. Sell to cover is the default arrangement and the best. In this guide we summarize how stock options are taxed in California covering the implications for ISOs NSOs and RSUs.

Instead of the employee receiving stock shares. Carol Nachbaur April 29 2022. And keep in mind that when your shares vest in 2021 and 2022 a portion will still be taxable in California.

As your actual tax rate increases including FICA state taxes etc it becomes more expensive to vest into RSUs.

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Units Driven Wealth Management San Diego Certified Financial Planner

Rsus Basics And Taxes San Francisco Ca Comprehensive Financial Planning

![]()

What The Heck Is An Rsu And What Do I Do With Mine And How Is It Different From A Bonus The Planning Center

Rsu Vs Rsa What S The Difference District Capital Management

What S The Difference Between Restricted Stock Units Rsus Restricted Stock Awards Rsas Sensible Financial Planning

Sunpower Spin Out 3 The Rsu Tender Offer Presentation

When Do I Owe Taxes On Rsus Equity Ftw

Restricted Stock Units Jane Financial

The Holloway Guide To Equity Compensation Holloway

Rsus Basics And Taxes San Francisco Ca Comprehensive Financial Planning

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Comments The Real Cost Of A Faang Relocation From California

Secfi How Are Stock Options Taxed In California

How Are Rsus Taxed In California Quora

When Do I Owe Taxes On Rsus Equity Ftw

Rsus Basics And Taxes San Francisco Ca Comprehensive Financial Planning